The coming US current account surplus

The last time the US current account was in surplus for any sustained period of time was up to 1982. An America in hock to the rest of the world and dependent on daily inflows of – at the latest count - $2.4 billion per day is such an accepted part of the world scene that we no longer reflect on it.

Few of us pause to consider that the fact that the US has a current account deficit at all is truly remarkable. Although the US demographic profile is more benign than that of most European and Asian countries – by 2050, even China will have an older population than the United States – it is still a mature economy with an aging population. This kind of economy ought, in fact, to have a current account surplus. Domestic actors should save for their retirement, investing the money abroad where returns are higher. Eventually, as people begin to retire, they turn from savers to spenders and the country goes into a current account deficit. But not, apparently the United States.

In addition, many US households feel that they are saving through the capital gains, initially on their shares and then, following the bursting of the dot-com bubble, on their houses. Hence, the household savings rate has been falling continuously for many years, finally going negative in 2005. As long as asset prices rise, that may not be a problem. But the US housing boom is now rapidly coming to an end. Although the Fed’s policy towards asset price bubbles is to let them inflate and then, if they burst, try to reflate somewhere else, it is now running out of balance sheets to trash.

Add to this two factors. The first, demographic. In five years’ time, the first cohort of baby-boomers is supposed to retire. ‘Supposed to’ – but unlikely to do so. The average private pension fund in the United States (i.e., the average of private pension funds among people who have them, as opposed to the average per total inhabitant) is allegedly in the region of $100,000. While this is a lot of money, it will not provide much of a pension – possibly $5-6,000 per annum.

At some stage between now and 2011, two things are therefore likely to happen. The first is that the 1946 cohort – the first baby-boomers – will realise that they cannot afford to retire at age 65 and will have to continue to work. That in itself is not so bad. Today’s 65-year olds are much stronger and healthier, physically and mentally, than their parents or grandparents were at the same age.

The second is less benign. That is that the decision to remain at work will be accompanied by a surge in savings. This is necessary since although the 1946 cohort can continue to work beyond 65, its remaining possible work span is still likely to be limited to a 5-10 year span. During this period, it will have to build up the savings on which it intends to retire. Of course, this is not a process taking place in steps. Once the cohort born 1946 draws this conclusion, then so too, and rather rapidly, will the cohorts born in 1947, 1948 and so on.

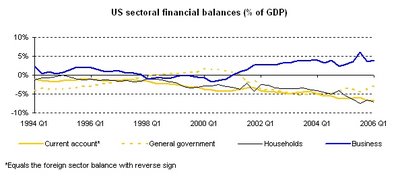

But increased US household savings have to be balanced by increased dis-saving by some other sector – corporate, public or foreign – as the sum of all sector’s financial balance by definition has to be zero. Looking realistically at the four sectors, the household sector’s long-term average financial balance (i.e. savings less investment) is ½% of GDP, against a current (Q1) balance of -7¼%. But we also have to assume that households will need to save more than their long-term average, given the short period in which the baby-boomers need to build up their savings. Meanwhile, housing investment is likely to weaken after the already visible end of the current housing boom.

If, therefore, we assume that the household sector’s financial balance will go to +1% of GDP over the next five years, which sector can give? The corporate sector’s current surplus of 3½% could possibly be narrowed to 2% before businesses start their self-defence mechanism – no more hiring, no more cap-ex. The public sector has a deficit of 3% - already the subject of much debate, even though this is narrower than the 5% seen three years ago. But it is unlikely that Americans will stand for a budget deficit widening to Japanese proportions. More likely, there will be continued efforts to narrow the deficit – meaning that the current level probably is the best attainable. This leaves the foreign sector surplus, i.e., the US current account deficit. But turning the household sector from a deficit of 7¼% of GDP to a surplus of 1%, with only 1½% narrowing of the business sector surplus therefore requires a 6¾% narrowing of the foreign sector’s surplus – as it happens, exactly its current size. The conclusion is therefore that the US over the next five years is likely to move into a current account balance or even surplus and remain there for a considerable period of time (until the baby-boomers do stop working and begin to retire).

0 Comments:

Post a Comment

<< Home